Effective from 4:30pm on 31 October 2024, QBANK will no longer offer phone banking facilities.

This decision has been made after careful consideration of several factors, including our long-term vendor ceasing support for phone banking services, and technology advancements that now provide more secure and user-friendly alternatives to phone banking.

From 31 October 2024, you will no longer be able to access phone banking services. However, you can continue to conveniently manage your accounts through:

Internet Banking: Click on the button in the top right corner to log in and perform transactions such as checking your balance, viewing your last five transactions, transferring money between accounts, and making BPAY payments.

QBANK Mobile App: Download our app from the App Store or Google Play to access banking services on your mobile device.

SMS and Email Alerts: Stay informed with real-time updates by registering for SMS and email alerts. Receive notifications for account balances, transaction activity, and more. If you have more than three QBANK accounts, we recommend using Internet Banking or the App to view all of your account information.

Here's a table highlighting the various methods available for managing your finances, from online banking to mobile apps and in-branch services.

If you have not logged in before or are not registered for Internet Banking, you can call our Member Service Team on 13 77 28 for a temporary password.

If you are registered for internet banking and have forgotten your password, click on "forgot password" and ensure you have your Member number, date of birth, and card number ready to reset your password.

You can download or update your QBANK App via the app store links below.

iPhone users can download the latest app from the App Store.

Android users can download the latest app from Google Play.

After installing or updating your mobile banking app to the latest version, you may need to register your account. To improve security and protection of your personal information, it is important to update your mobile banking app regularly as it becomes available.

*Our iOS app requires iOS 11 or above on your device to be installed.

*Our Android app requires Android 7.0 or above on your device to be installed.

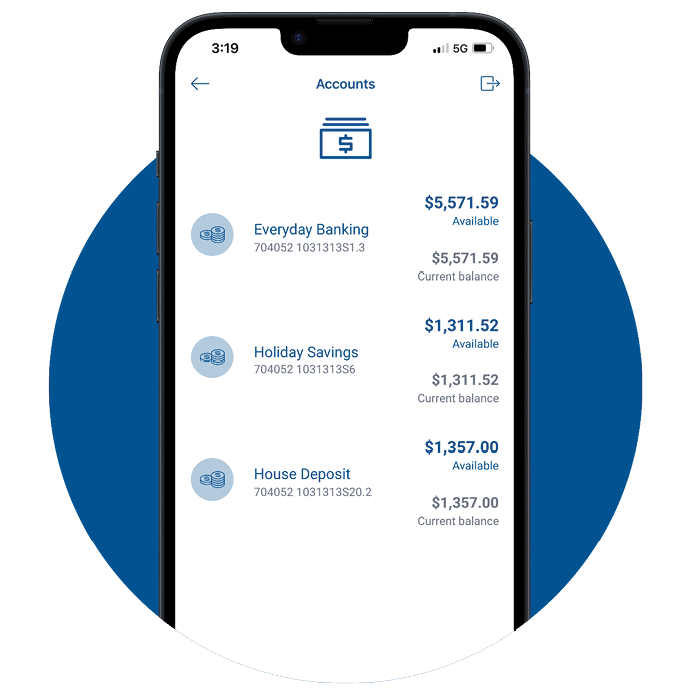

1. Log into the QBANK App.

2. Click on Accounts in the lower left corner.

3. You will see all your accounts. The current balance is listed under available.

1. Go to Internet Banking page in top right corner of QBANK website. Log into internet banking

2. Your list of accounts will appear.

3. Your current balance will be on the right side of the account bar.

1. Log into the QBANK App.

2. Click on Pay in the centre at the bottom and select BPAY.

3. If you have not added the payee before, click on New in the top right corner and follow the instructions to setting up a new Payee.

4. Select the payee and then select the account to pay from and the amount, then click pay.

1. Log into Internet Banking in the top right corner of QBANK Website.

2. Click on payments at the top of the page and select transfer money.

3. Select the account to pay from and then select the Payee. You can add a new payee here as well.

4. Fill in the amount and then select next and follow the instructions.

1. Log into the QBANK App.

2. Click on Accounts in the lower left corner. Select the account to see the transactions.

3. Your transactions will be listed beneath the details.

1. Log into Internet Banking in the top right corner of QBANK Website.

2. Your list of accounts will appear. Select the account you want to see the transactions of.

3. A list of your most recent transactions will appear.

1. Log into the QBANK App.

2. Click on Pay in the centre at the bottom. Select transfer.

3. Select the account to transfer from and to transfer to. Type the amount and then click on ‘Pay’.

1. Log into Internet Banking in the top right corner of QBANK Website.

2. Click on payments at the top of the page and select transfer money.

3. Select the account to pay from and then select the account to transfer to.

4. Fill in the amount and then select next and follow the instructions.

QBANK has decided to discontinue phone banking services effective from 31 October 2024 due to several reasons:

After 31 October 2024, you can manage your accounts through:

No, the Member Service Centre phone number remains the same. You can reach our Member Service Team on 13 77 28, Monday to Friday, from 8:45am to 4:30pm for any assistance you may need during the transition.

We understand that this change may impact some Members differently. Our Member Service Team is committed to assisting all Members during the transition. We encourage affected Members to reach out to us for personalised assistance.

Please ensure you transition scheduled payments to Internet Banking or the QBANK app before 31 October 2024. Our Member Service Team can guide you through this process and ensure a smooth transition.

Yes, you can continue to receive paper statements. Please contact our Member Service Team to arrange this option.

Yes, QBANK will provide resources and support to assist Members in transitioning to Internet Banking or the QBANK app. Contact our Member Service Team at 13 77 28 for personalised assistance.

If you experience any technical difficulties, please contact our Member Service Team at 13 77 28. Our team is available to provide technical support and assistance.

There are no changes to fees or charges associated with this transition. QBANK remains committed to providing transparent and competitive banking services to our Members.

We will update our General Information Terms and Conditions to reflect this change from 1 November 2024. The current version is available here.